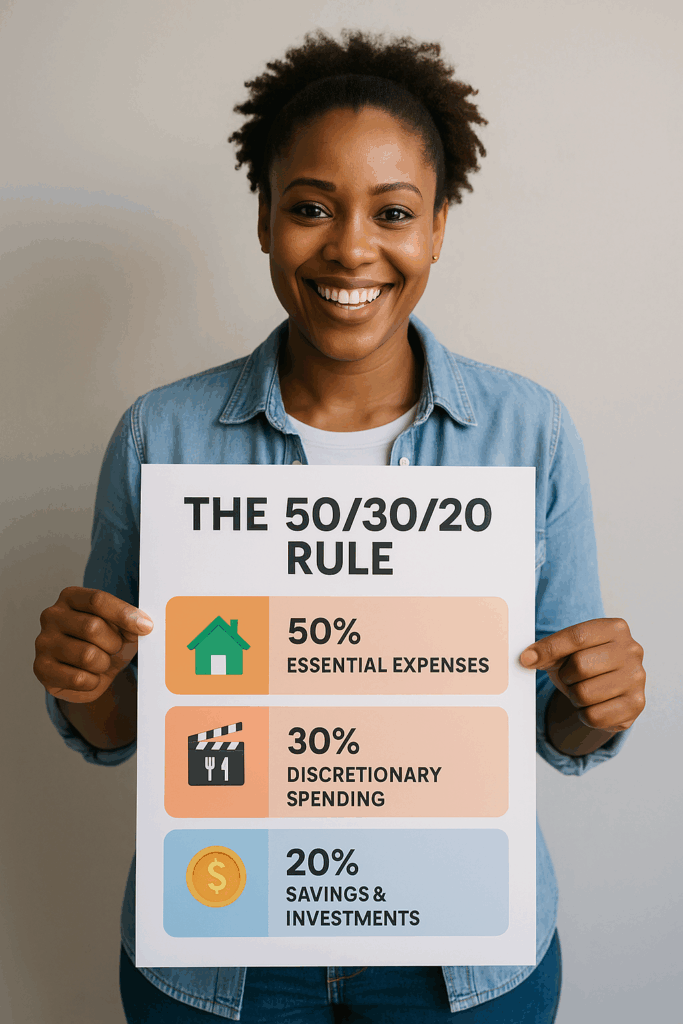

In a world where expenses keep rising and income often feels stretched thin, one of the best ways to take charge of your financial life is by mastering the 50/30/20 rule. This timeless budgeting method simplifies the complex world of money management and helps you build a future of balance, discipline, and freedom—no matter your income level.

So, what exactly is the 50/30/20 rule, and how can you apply it in your everyday life?

✅ 50% – Essentials: The Must-Haves

The first half of your income should go toward essential expenses—things you can’t live without. These include:

-

Rent or mortgage

-

Groceries

-

Electricity, water, and utility bills

-

Transport or fuel

-

Debt repayments

These are non-negotiable costs that ensure you can live, work, and stay safe. If your essential expenses exceed 50%, it’s time to assess what you can reduce or negotiate—like cheaper housing or better repayment terms.

🎉 30% – Lifestyle & Flexibility: The Want-to-Haves

This is the part of your income that makes life enjoyable. While not critical for survival, discretionary spending improves your quality of life and includes:

-

Eating out

-

Streaming subscriptions

-

Clothing and gadgets

-

Vacations or weekend getaways

-

Gifts and celebrations

The key is not to eliminate these expenses but to keep them in check. By capping them at 30%, you get to enjoy life while staying financially responsible.

💰 20% – Savings & Investments: Your Future Safety Net

The final 20% of your income should be directed to:

-

Emergency savings

-

Long-term investment accounts

-

Retirement funds

-

Debt reduction (if you have high-interest debt)

This category is your lifeline for financial independence. Whether it’s a rainy-day fund or investing in assets that grow over time, this is how you protect your future self.

📲 How PhosMonie Can Help You Stick to the 50/30/20 Rule

Managing your budget manually can be overwhelming. That’s why apps like PhosMonie make it easy to:

-

Track your expenses across essentials, wants, and savings

-

Automate bill payments and airtime/data top-ups

-

Fund your savings wallet or virtual card for specific budget categories

-

Use analytics features to monitor how your income is split

-

Set goals for spending, saving, or investment purposes

With friendly fees, a seamless interface, and 99% uptime, PhosMonie gives you the power to spend smart and live freer—exactly what the 50/30/20 rule is all about.

✨ Final Thought

Sticking to a budget doesn’t mean living a restricted life. It means gaining the freedom to choose, knowing where your money goes, and being prepared for what’s ahead.

Apply the 50/30/20 rule today and take control of your financial story—one paycheck at a time.

Ready to make it easier?

Download PhosMonie today. Your smarter money life starts here.